Automatically match inbound deals to your fund mandate, flag risks early, and trigger deep research — all before anyone reads a page.

Gain a consistent, comparable view of your pipeline, tag and track deals with your team, and benchmark cases using AI.

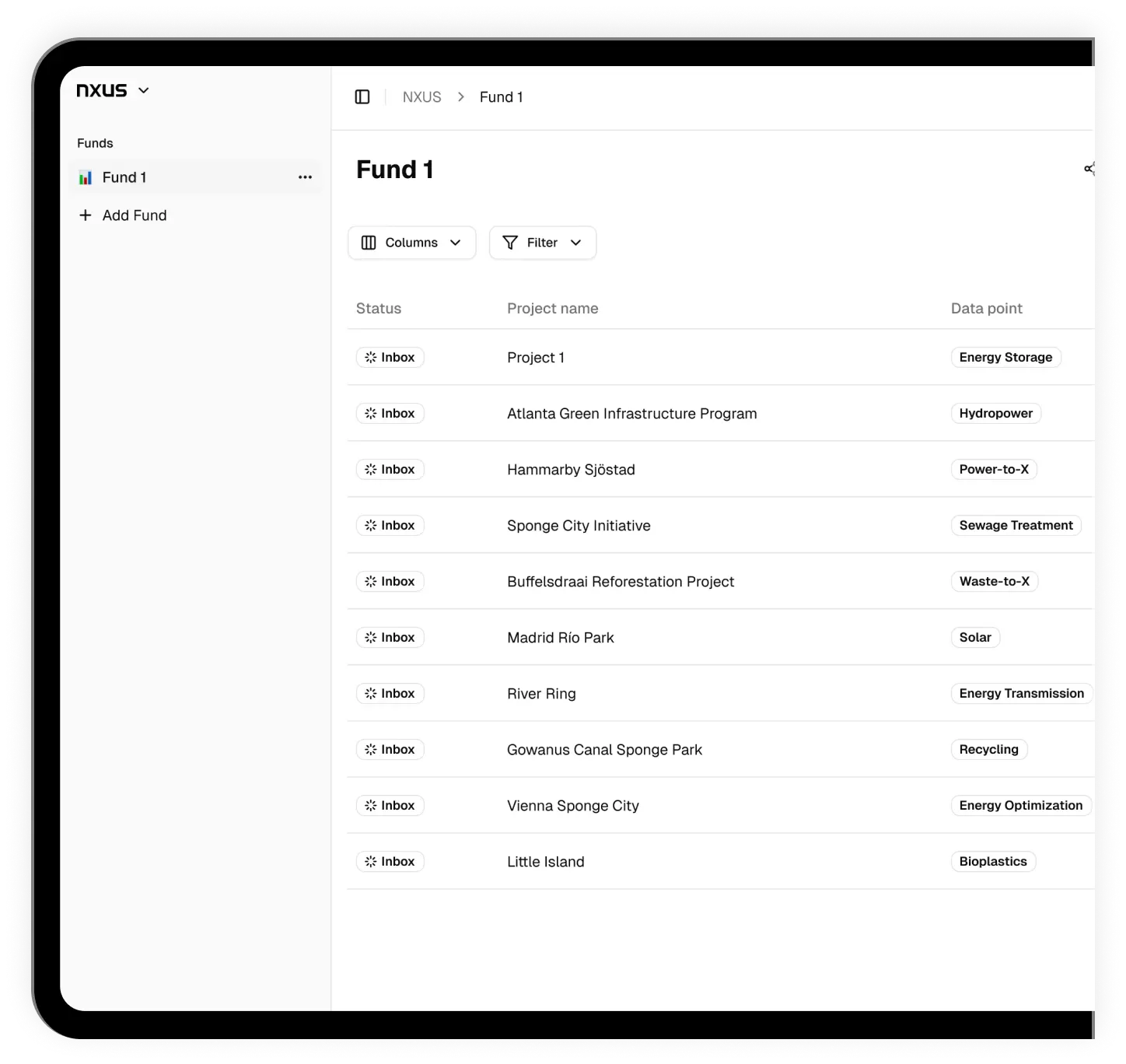

Define and adjust your mandate, get alerted on high-fit deals, and manage your entire deal flow in one place.

Configure your investment strategy, agents, scoring models, and filters - all aligned to your fund’s thesis.

With NXUS your pipeline is always clean, with documents parsed and your mandate logic embedded from the start.

Our experts combining the best technology with the needs of investment analysts.

Agents work in the background to qualify cases, set red flags, and surface relevant opportunities before your team ever opens the file

Drop in your documents — our AI extracts the key numbers, maps them to your model, and flags what’s missing

Custom scoring built around how your fund thinks. Benchmark new cases against internal priorities, automatically

Assign tasks, leave notes, track progress per opportunity — all in sync with your fund’s mandate and deal pipeline

“Artificial intelligence is not a substitute for human intelligence — it is a tool to amplify human creativity and judgment. In the years ahead, it will transform every industry it touches, redefining how we analyse, decide, and invest.”